You will also hear this report called an Income Statement or a Profit & Loss Statement. The Statement of Activities shows how your organization’s resources were earned and how they were spent over a specific period.It connects financial activity to mission effectiveness, helping stakeholders assess the nonprofit's performance and sustainability. While for-profit organizations use their Income Statement to assess profitability, nonprofits use the Statement of Activities to evaluate how revenue and expenses are being utilized to support their mission. It will also be used by your tax preparer when filing your Form 990.

Unrestricted vs Restricted

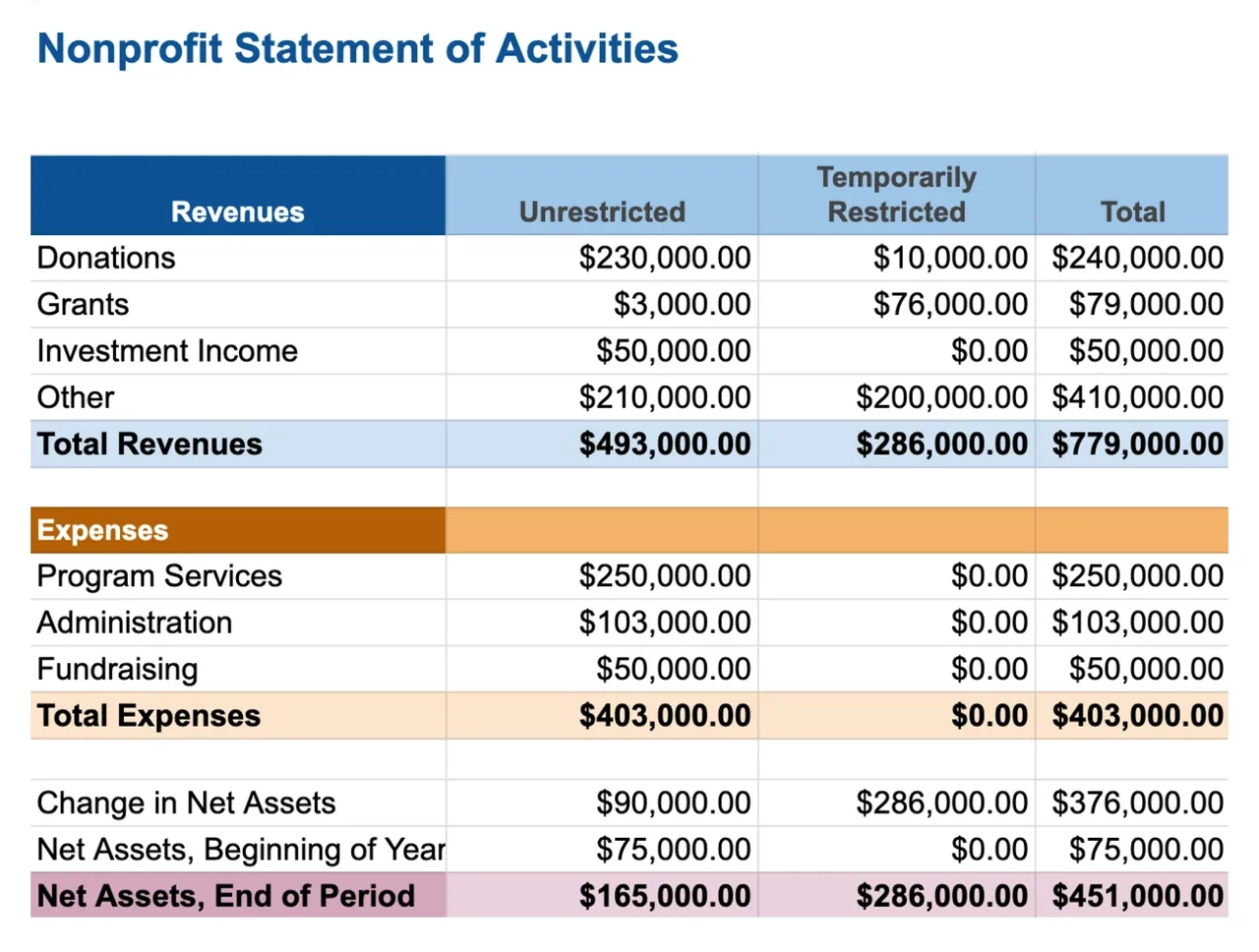

Nonprofit organizations often receive revenue with restrictions set by the fund source. For example, a grantor might require that their funds be used for a specific program or purpose.Restricted revenue must be spent exactly as the donor intended, while unrestricted revenue can be used by the nonprofit however it sees fit—whether for operations, projects, or other expenses.The nonprofit Statement of Activities clearly separates restricted and unrestricted revenue, helping organizations understand how much flexibility they have with their funding.

Key Sections

Section 1: REVENUE:This is the money coming into your organization. It includes donations, grants, program service revenue, and investment income. A little about each source of revenue:

Cash Contributions: When nonprofits raise funds from individual donors, major supporters, or corporate partners, these are classified as cash contributions.

In-Kind Donations or Non-cash Contributions: Nonprofits receive valuable support through non-cash contributions, which can include donated goods, services, assets like land or stocks, equipment, or professional services. These donations are crucial to recognize in financial reports, as they represent significant resources that support the organization's mission, even though they do not involve direct monetary transfers.

Grants: Funds received from government entities or private foundations are considered grants. It’s crucial to include this revenue in your statement of activities.

Program Fees: Nonprofits often generate income by charging fees for services or membership, which can make up a significant portion of their funding. For example, many associations charge members to access benefits.

Net Assets Released From Restrictions: These are funds that were restricted, but can now be used for any purpose at any time.

Section 2: EXPENSES:Your organization’s expenses should support its mission, whether it’s covering daily operations or specific projects.

FASB requires you to report expenses by function, breaking them down into categories like administrative, fundraising, and program costs.

Some example of operating expenses are:

Rent and utilities

Professional Services (legal, bookkeeping, etc)

Salaries and benefits

Fundraising expenses

Office supplied and equipment

Insurance

Program expenses vary widely between nonprofits so they will be particular to your organization

Sections 3: CHANGE IN NET ASSETS:Your change in net assets are simply your revenue minus expenses, giving you a snapshot of your organization’s financial health and sustainability. It's important to distinguish between restricted and unrestricted net assets, as restrictions may limit your access to certain funds, potentially leading you to believe you have more income available than you actually do.

Key Insights From The Statement Of Activities

Revenue Composition: Highlights funding sources (e.g., donations, grants) and shows reliance on specific streams.

Expense Allocation: Breaks down costs into program, administrative, and fundraising categories, revealing efficiency in mission spending. It helps you determine where your hard-earned fundraising dollars go.

Net Change in Assets: Indicates whether the nonprofit operated at a surplus or deficit, informing financial sustainability.

Donor Restrictions: Distinguishes between restricted and unrestricted funds, showing flexibility in resource use.

Budgeting: When reviewing your nonprofit's Statement of Activities, you should ensure that the line items align with those in your organization’s budget. This comparison helps confirm that your organization is staying on track with its planned operating expenses.

Impact of Year-End Closing on the Statement of Activities

Closing the books at the end of the year is a critical financial management process that helps your nonprofit understand its financial performance and prepare for the future. Think of it like an annual financial reset button that does three important things:

1. Net Assets Transfer: At year-end, the net change in your organization's financial position (total revenues minus total expenses) gets transferred to your Statement of Financial Position (balance sheet). This transfer shows whether you ended the year with a surplus or deficit, which is crucial for understanding your financial health. Impact: The net asset transfer creates a direct bridge between the income statement and the balance sheet, reflecting the organization's profitability and financial momentum from the past year.

2. Fresh Start for the New Year: Once the books are closed, your revenue and expense accounts are reset to zero. This means you start the new fiscal year with a clean slate, ready to track a new year's financial activities without any lingering balances from the previous year. Impact: Resetting accounts ensures a clear and unencumbered starting point for the income statement, allowing for precise tracking of financial performance in the upcoming fiscal period.

3. Financial Performance Snapshot: The year-end closing process finalizes your nonprofit's financial results for the year. It ensures that all revenues and expenses are accurately recorded and categorized, giving you a clear picture of how your organization performed financially. Impact: This comprehensive review directly influences the income statement by providing a definitive and accurate representation of the organization's financial performance for the reporting period.Understanding your Statement of Activities is more than just a financial exercise—it's a strategic tool that provides critical insights into your nonprofit's mission and financial health. By carefully analyzing your revenue sources, expense allocations, and net asset changes, you gain a comprehensive view of how effectively your organization is translating financial resources into mission impact.

Outsourcing your bookkeeping to a professional nonprofit bookkeeper is a smart, cost-effective choice. They can help create and interpret your financial statements, streamline tax season, and highlight the important financial insights you need to focus on to help your organization thrive.

Get help by SCHEDULING A FREE CONSULTATION now

Other Important Financial Reports

Statement of Financial Position: A Leader's GuideCash Flow Statement Insights Nonprofit Leader Should KnowStatement of Functional Expenses: A Nonprofit Leader's Guide