Generating a Quickbooks Donation Receipt for In-Kind Donations

In-kind donations are non-cash gifts, such as donated equipment, professional services, or supplies. In-kind donations can be relatively easy to book.

Let's say we are accepting a fixed asset, like a couch. To book this we would increase the fixed asset account, let's call it Furniture, and increase an income account, let's call it In-kind Contributions. If we put this in terms of debits and credits, we would debit the Furniture account and credit the In-kind Donation account.

Your donor will likely want a receipt for the donation. QuickBooks is limited in this regard. You would use the sales receipt functionality to generate the donation receipt, but it won't let you pick a fixed asset account when generating the receipt. You have the option to create a donation receipt outside of QuickBooks, but if your want to use QuickBooks, you will need a workaround. This post will walk you through it step by step.

Before we begin, it’s helpful to first familiarize ourselves with a couple of key concepts:

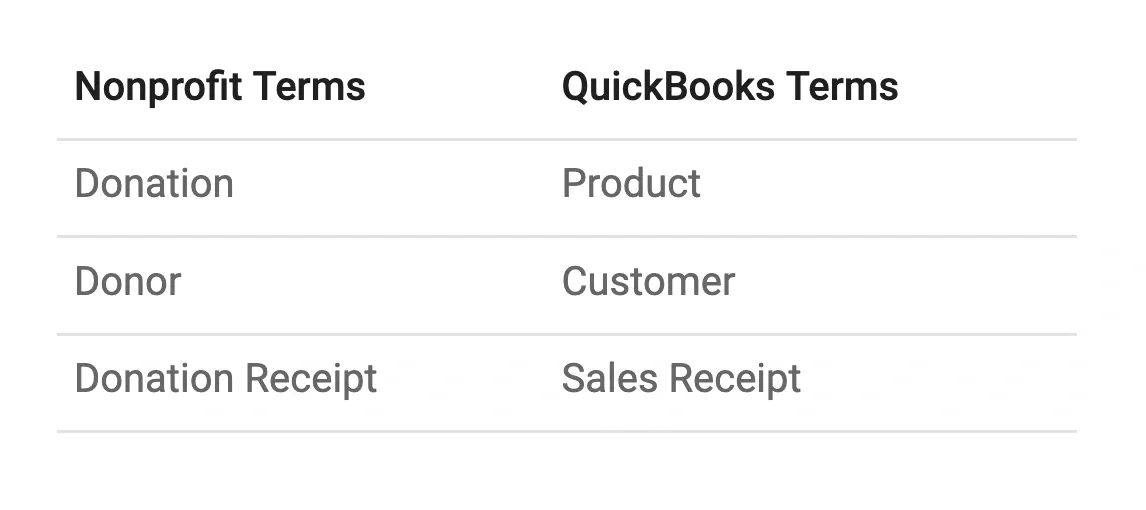

1. TerminologyQuickBooks often uses for-profit terms that aren't intuitive for nonprofit organizations. Here’s a list that translates QuickBooks receipt terminology into its nonprofit equivalent.

2. 'Deposit to' AccountTo record your in-kind donation, you'll want to use a Sales Receipt. Why? This will generate a receipt to provide to your donor. The challenge with using a sales receipt for in-kind donations is that you’ll need to select a Deposit To account, but the options QuickBooks presents won't include the appropriate account type. So, we need a workaround.

The solution is to create an account called In-kind Clearing Account and set it up as an account type that will appear in the dropdown list. Once we've created the sales receipt, we'll then make a journal entry to move the transaction to the correct account. It might be more efficient for a volunteer or staff member to create the sales receipt, while the bookkeeper handles the journal entry.

Let's get Started

To record our in-kind donations, we are going to:

Create a Clearing Account

Create a Sales Receipt, and

Adjust the Value to the Correct Account

Creating the Clearing Account

From the menu, click Transactions, then select Chart of Accounts.

Click the New button

Enter In-kind Clearing account for the Account Name

Select Other Current Assets for the Account Type. This is how to make it show up as one of the options for Deposit to. Only Other Current Assets are available in the list.

Select Other Current Assets as the Detail Type. This doesn’t matter much, but the default value for this field can be confusing.

Click Save.

Creating the Sales Receipt

The default for-profit language in the Sales Receipt may not suit your needs, so you might want to customize it before proceeding with these instructions.

Establish the value of the donation. Unlike cash donations, the value of an in-kind donation is not known, so you will need to determine its Fair Market Value. The IRS requires that the donor establish this value for tax purposes, but if they ask for guidance, you can suggest IRS Publication 561 or the Salvation Army’s published evaluations. Ultimately, however, you cannot establish the value for tax purposes. If the value is for internal reporting only, you can use an estimate. Consult with your accountant for guidance on establishing Fair Market Value.

Once you have the Fair Market Value, go to the + New button and select Sales Receipt.

Enter the Customer name. QuickBooks uses the term Customer instead of Donor, so type the donor's name into the customer field. If the donor has donated before, their name will appear in the search results. If it’s a new donor, click + Add New, enter their details, and click Save.

Select Cash as the Payment Type.

For Deposited to, choose the In-kind Clearing account (the account you set up earlier).

Under Product/Service, either select an existing product or create a new one. In QuickBooks, create a new product for donations when you need to track a distinct type of donation separately from others, especially if it needs to be reported on uniquely. For example, if you receive general donations, restricted grants, and in-kind contributions, you may want to set up separate products for each to track them accurately and align with fund accounting principles. Each product can be mapped to a specific income account that reflects the nature of the funding, such as Restricted Donations or General Contributions. To avoid clutter, create new products only when there’s a specific need to differentiate income streams—typically, one product per income account or per type of donation category is sufficient. Having well-defined products helps streamline donation tracking and reporting. See Donations are Products in QuickBooks: How To Set Them Up, for further details.

Enter the donation amount for the transaction.

It's time to Save the receipt. You have three options:

Save and Send will walk you through emailing the receipt to the donor.

Save and New will save the receipt and open a new one, allowing you to input the next donation.

Save and Close saves the receipt and closes the form.

Adjusting the Value to the Correct Account

Remember how only accounts categorized as Other Current Assets will appear in the Deposit To list when you create a sales receipt? In-kind donations come in several forms, and many of these may not be classified as current assets. This is why it’s necessary to move the donation to the correct account now. You could have skipped creating the sales receipt and used a journal entry to record the donation directly to the correct account, but then you wouldn’t have a donation receipt to provide to the donor.

If you’re unsure which account to use for your in-kind donation, consult your bookkeeper or accountant.

Let’s say we’re accepting an in-kind donation of a couch — a fixed asset. We’ll assume the fair market value of the couch is $1,000. After creating a sales receipt and selecting In-kind Clearing as the Deposit To account (which is an Other Current Asset account), we now need to move the $1,000 from the In-kind Clearing account to a Fixed Asset account called Furniture. Here are the steps to transfer the funds:

Click the + New button.

Select Journal Entry.

Select the correct Date

On the first line, set the following values. Account: In-kind Clearing account. Credit: $1,000. This will decrease the In-kind Clearing account to $0.00. If it's confusing to think that crediting an account decreases its value, you are not alone. It's not intuitive. Check out How to Overcome Debit and Credit Confusion.

One the second line, set the following values. Account: Furniture. Debit: $1,000. This will increase the value in the Furniture account by $1,000.

Enter a Description. It's helpful to include a clear description. For example, in this transaction, you could use "In-kind donation of a couch." It's common practice to use the same description on both the debit and the credit lines.

You probably also want to add a class. For nonprofits, we need to track the function of the money we get and spend. That's beyond the scope of this post, but you can check out Using Classes To Track Function in QuickBooks.

Click Save.

That's it. Your in-kind donation has been correctly recorded!