The Cash Flow Statement primarily focuses on liquid cash, meaning actual cash that the organization has on hand, and cash equivalents. Cash equivalents are short-term investments that can quickly be converted to cash, such as money market funds or Treasury bills.It does not include things like stocks, accounts receivable, or payables, which are not considered liquid cash.The goal of the Cash Flow Statement is to track the actual cash your organization has access to, showing how it comes into the organization and how it is spent over a specific period—whether monthly, quarterly, or annually. This helps ensure you have enough funds to support your mission, meet your obligations, and plan for the future.Nonprofits usually create this report every month to make sure their spending and the money they make match up with their annual operating budgets.

Key Parts of a Nonprofit Cash Flow Statement

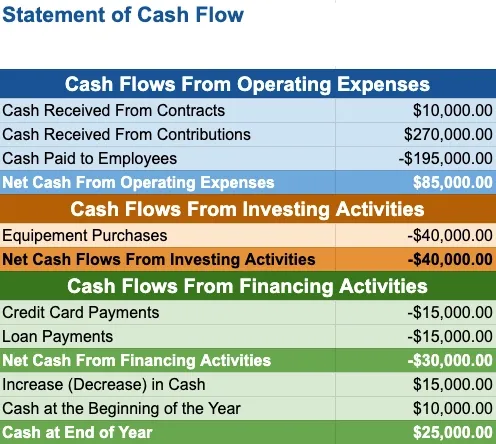

Edit ImageA Cash Flow Statement for nonprofits is typically divided into three sections:Section 1: Operating Activities This section tracks the cash that comes in and goes out as a result of your nonprofit’s day-to-day activities, primarily related to your mission. It includes:

Cash Inflows: Revenue generated from donations, grants, fundraising events, and membership fees.

Cash Outflows: Payments for operating expenses such as salaries, rent, utilities, program costs, upfront fundraising campaign costs, and supplies.

What it tells you: The operating activities section helps you understand whether your nonprofit is generating enough cash from its core activities to sustain operations. If cash inflows from donations or grants are not enough to cover expenses, you may need to adjust your fundraising strategy or manage costs more efficiently.

Note: In-kind donations and sponsorships usually don’t appear on the cash flow statement. This is because when you get goods, services, or other non-cash donations, it doesn’t change the amount of cash your organization has.Section 2: Investing Activities This section records the cash flow associated with investments in assets or other long-term ventures, such as purchasing property, equipment, or investments that will support future growth.

Cash Inflows: The sale of property or investments or interest/dividend payments earned on investments.

Cash Outflows: Purchases of long-term assets like equipment, buildings, or vehicles; spending money on improvements to existing fixed assets; investing reserve funds into new things like stocks, bonds, etc.

What it tells you: This section gives insight into how much your nonprofit is investing in its future. Large outflows here might suggest that your nonprofit is expanding its capacity to deliver services, but it also means that cash is being tied up in assets, which might limit flexibility for short-term needs.

Section 3: Financing Activities Financing activities involve the cash flows related to debt financing or other forms of external support.

Cash Inflows: New loans or capital contributions.

Cash Outflows: Repayment of loans or long-term debt.

What it tells you: This section shows how your nonprofit is managing its financial leverage. Are you relying on loans or external financing to fund your programs? How much of your nonprofit's cash is being directed toward paying down debt? This can impact your ability to fund future initiatives.

Key Insights from Your Cash Flow Statement

By looking at each of these three sections, you can glean valuable insights into the financial health and future outlook of your nonprofit. Here’s what you can learn:

Cash Liquidity: The cash flow statement shows you how much cash you have on hand to cover immediate operational needs. If the cash flow from operating activities is consistently negative, you may need to reassess your income generation strategy or find ways to reduce expenses.

Budgeting: Understanding how money comes in and goes out each month helps you plan your future budgets. For example, your cash flow might show you earn more money in the spring during your big funding drive, but spend more on programs in the fall. This lets you adjust your budget to match these patterns.

Sustainability of Operations: Positive cash flow from operating activities indicates that your nonprofit can sustain its operations with the revenue generated from its core mission. Negative cash flow could suggest that you are spending more than you’re bringing in, which could be a warning sign for the financial health of your organization.

Investment and Growth Plans: By reviewing your investing activities, you can assess how much your nonprofit is investing in its future growth. If you’re purchasing property or assets, this may be a sign of expanding your capacity to serve more people or improve programs. But, it also means cash might be tied up in assets, which could limit flexibility in the short term.

Financial Flexibility: The financing activities section shows how much external funding or debt your nonprofit has taken on. If you rely too heavily on loans or external financing, it might be time to reconsider your strategy for growing revenue sustainably.

Why Your Cash Flow Statement Matters

Cash flow management is essential for any nonprofit to thrive. A positive cash flow allows you to pay your staff, fund your programs, and invest in your future growth. On the other hand, poor cash flow can lead to missed opportunities, the inability to pay bills on time, or even solvency problems.Your Cash Flow Statement is not just a report of past activity—it’s a tool to help you make smarter financial decisions for the future. By regularly reviewing this statement, you can adjust your fundraising, spending, and investment strategies to ensure that your nonprofit remains financially healthy and mission-driven.

By working with an expert nonprofit bookkeeper, you can ensure you're fully understanding and making the most of your Cash Flow Statement to support your nonprofit’s unique needs and goals.

Get help by SCHEDULING A FREE CONSULTATION now

Other Important Financial Reports

Statement of Financial Position: A Leader's GuideStatement of Activities: Your Nonprofit’s Story of Impact

Statement of Functional Expenses: A Nonprofit Leader's Guide