For nonprofit leaders, understanding financial statements is more than a technical skill—it’s a way to ensure your organization fulfills:

its mission effectively,

remains accountable to donors and stakeholders, and

complies with legal and regulatory requirements.

What Can Financial Statements Help You Do?

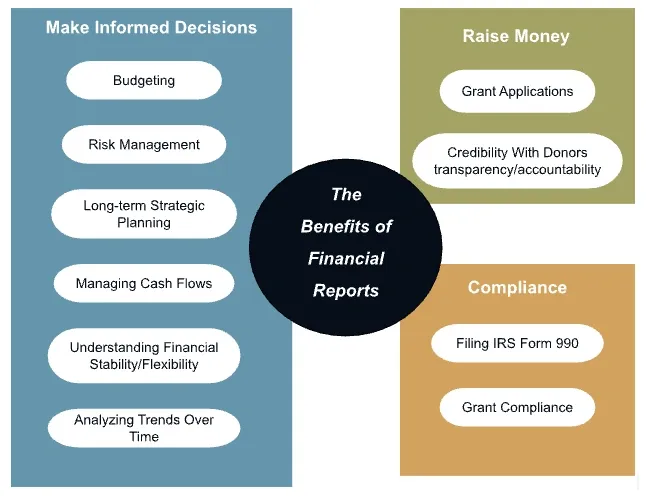

Financial statements are crucial for understanding your nonprofit’s financial health, making informed decisions, and raising new funds.

If financial reports feel overwhelming, you're not alone. Many nonprofit leaders come from mission-driven backgrounds, not finance. Here are some simple guides to help you understand the essentials of your nonprofit’s key financial statements and how you can use them:

1. Guide to the Statement of Financial PositionThe Statement of Financial Position shows what you own, what you owe and what's left over. It helps you answer questions like:

Are we stable enough to grow or start new projects?

How much cash do we have for emergencies or unexpected costs?

Can we take on more debt, or is it too risky?

Can we afford to pay our bills and keep running?

2. Guide to the Statement of ActivitiesThe Statement of Activities shows how much money your nonprofit earned and spent over a certain time. It helps you answer questions like:

Are we bringing in enough money to cover our costs?

How well are we using our funds to support our mission?

Are we spending too much administration?

3. Guide to the Statement of Cash FlowsThe Cash Flow Statement shows how cash is coming in and going out of your nonprofit over time. It helps you answer questions like:

Do we have enough cash to pay our bills right now?

Are we spending too much too quickly?

4. Guide to the Statement of Functional ExpensesThe Statement of Functional Expenses breaks down where your nonprofit spends its money. It helps you answer questions like: